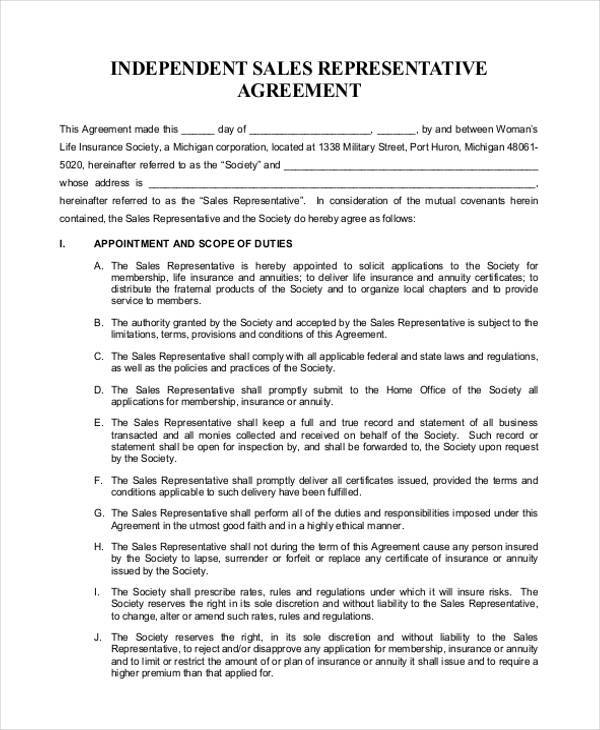

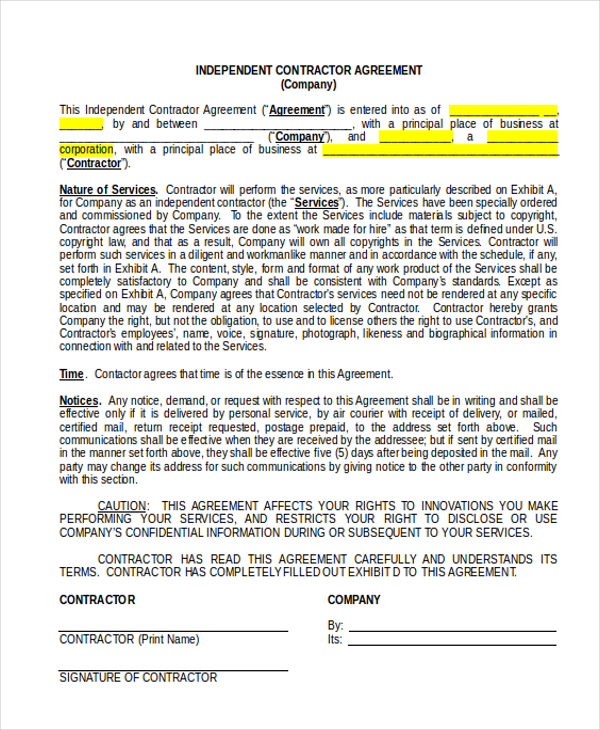

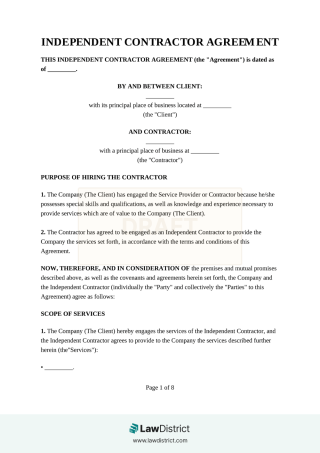

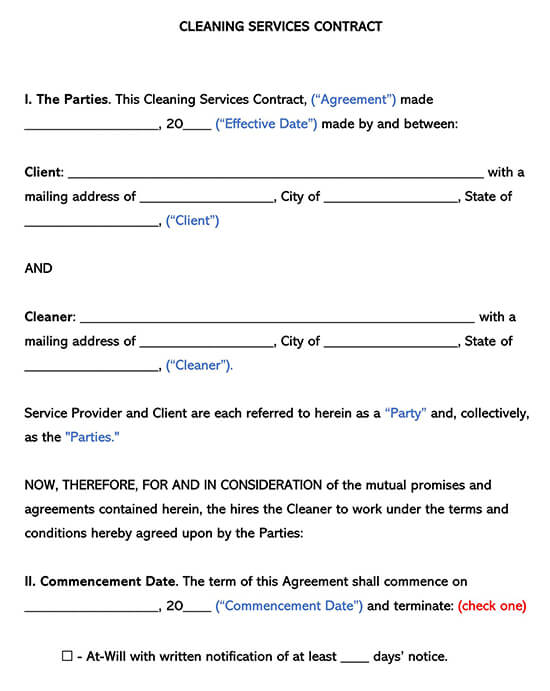

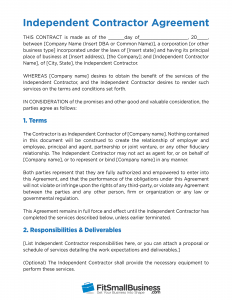

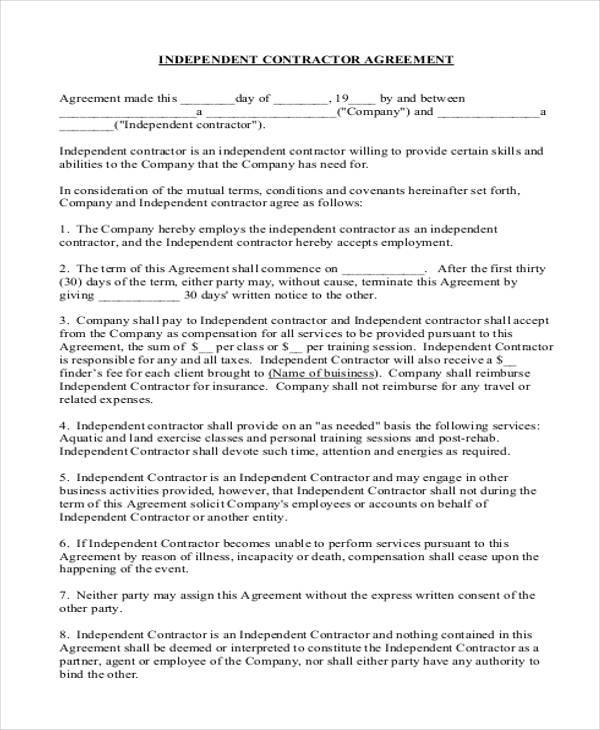

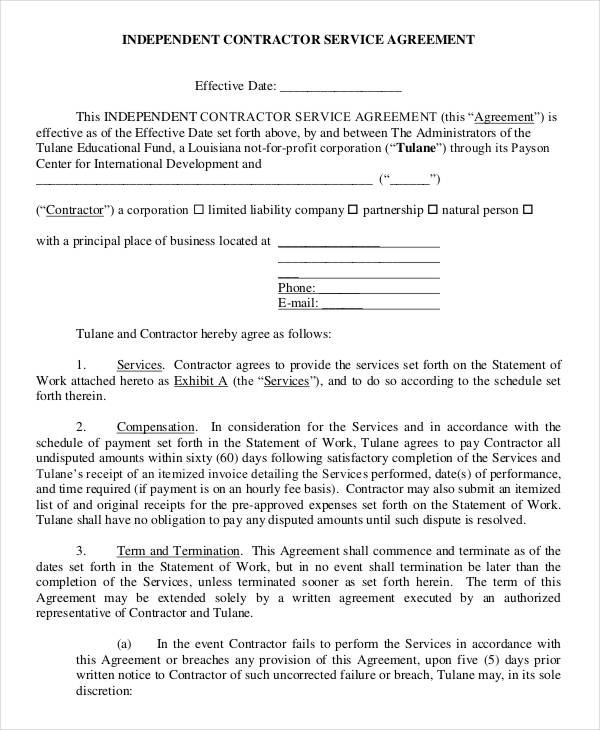

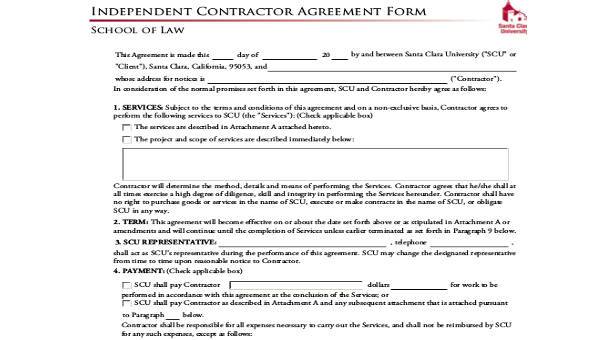

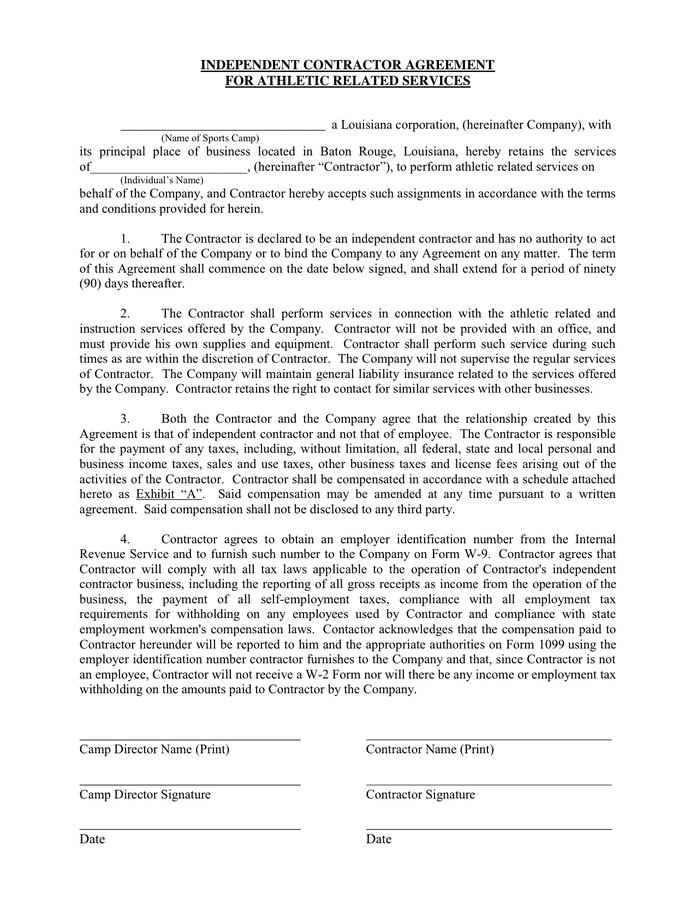

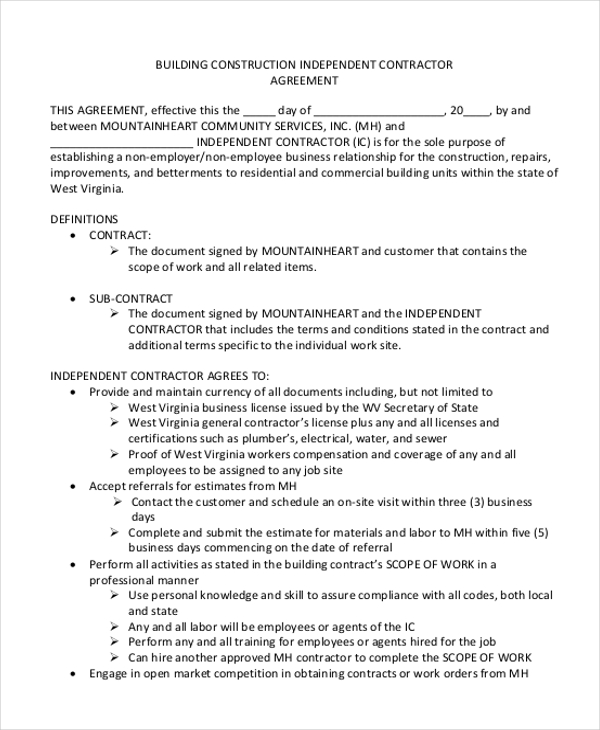

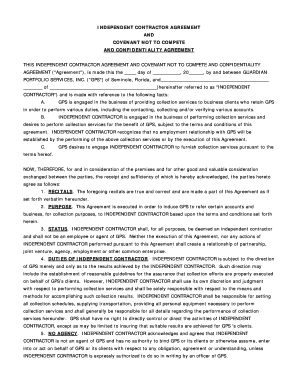

The Independent Contractor Agreement is a generic template between two parties, who are The Company and The Contractor This is when you need an independent contractor who will provide the specific skills and abilities that the company needs The agreement sets forth a number of various terms and conditions and specific details Simple Independent Contractor Agreement Publicerat den 12 april, 21 av Emma N By using a template for independent contractor agreements, you ensure that any staff member who is part of the recruitment process uses aAnd Independent Contractor agree as follows 1 Work Status The Employer hereby employs the Independent Contractor as an independent contractor, and the Independent Contractor hereby accepts employment 2 Start Date The term of this Agreement shall commence on _____, ____ Either party may, without cause, terminate this Agreement by giving ____ day(s') written notice

Independent Contractor Agreement Form California Elegant Independent Contractor Tax Forms Sample 1099 Form Beautiful Luxury Models Form Ideas

1099 contractor simple independent contractor agreement

1099 contractor simple independent contractor agreement-US Legal Forms is the perfect platform for finding uptodate SelfEmployed Independent Contractor Agreement templates and a copy of 1099NEC must be provided to the independent contractor by January 31 of the year following payment Keep it simple Deal with the right personThis 'DELIVERY DRIVER INDEPENDENT CONTRACTOR AGREEMENT' ("Agreement") is made by and entered into between Company requires such services to be performed exclusively and by the Contractor him/her self 23 The Contractor shall make each delivery in safe and careful manner and complete each deliver within a reasonable amount timeAn independent contractor may

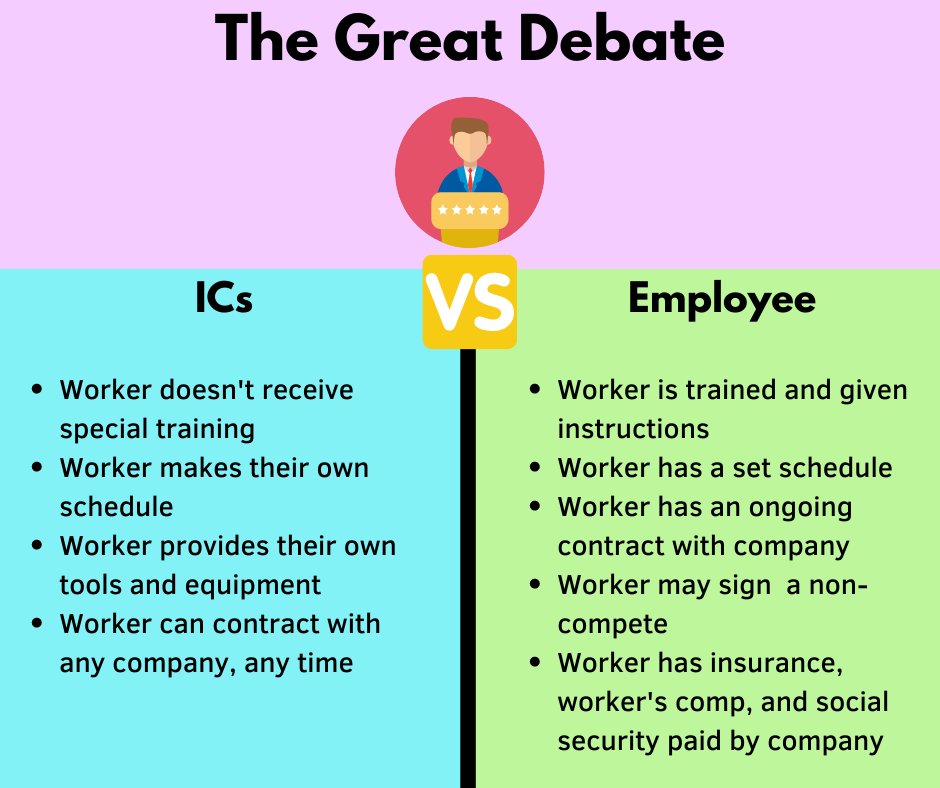

Independent Contractors Vs Employees Not As Simple As You Think New York Truckstop

A list of job recommendations for the search sample 1099 independent contractor agreementis provided here All of the job seeking, job questions and jobrelated problems can be solved Additionally, similar jobs can be suggestedRelated to What is a 1099 contractor agreement?Independent Contractor Agreement (1099) An independent contractor agreement is a contract between a client that pays a 1099 contractor for their servicesAn independent contractor is not an employee In most cases, an independent contractor is paid on a perjob or percentage (%) basis, not by the hour ($/hr)

That in performing under the Agreement;いろいろ 1099 contractor simple independent contractor agreement 4266How do you 1099 an independent contractorSee Appendix D for a general template for an Independent Contractor Agreement 5 Have Copies of all 1099 forms you file 7 File Form 1099‐MISC The basic rule is that you must file a Form 1099‐MISC whenever you pay an unincorporated IC (that is an IC

You are wise to get this agreement signed with independent contractors to protect your interests in any IRS audit It serves to document the provider's role as a 1099 contractor as opposed to being an employee 1 Make multiple copies Put one in the file kept for the individual service provider and another in your accounting files4 D) It is agreed that additional deductions is setup per Commercial Motor Vehicle at the time of the agreement,as followed below 1 INDEPENDENT CONTRACTOR authorizes CARRIER to withhold $ US dollars per week for cargo / liability insurance regardless of operation or not 2 INDEPENDENT CONTRACTOR authorizes CARRIER to withhold $ US dollars per weekFree Contractor Agreement Free To Print, Save & Download wwwrocketlawyercom › Contractor › Agreement rocketlawyercom has been visited by 100K users in the past month We provide simpletouse Independent Contractor Agreements

Independent Contractors Vs Employees Not As Simple As You Think New York Truckstop

Free Independent Contractor Agreement Create Download And Print Lawdepot Us

A 1099 employee is a selfemployed independent contractor who works for you and can work for other employers Therefore, no employeremployee relationship exists and they are not eligible for your group health insurance planBackup withholding, if required for your contractorIndependent contractors have fewer directions and use their own expertise and judgment to perform their work This Independent Contractor Agreement (this "Agreement" or this "Independent Contractor Agreement"), effective as of date (the "Effective Date"), is made and entered into by and between

38 New Finders Fee Agreement Sample Models Form Ideas Get Simple Fee Agreement Form Pictures

2

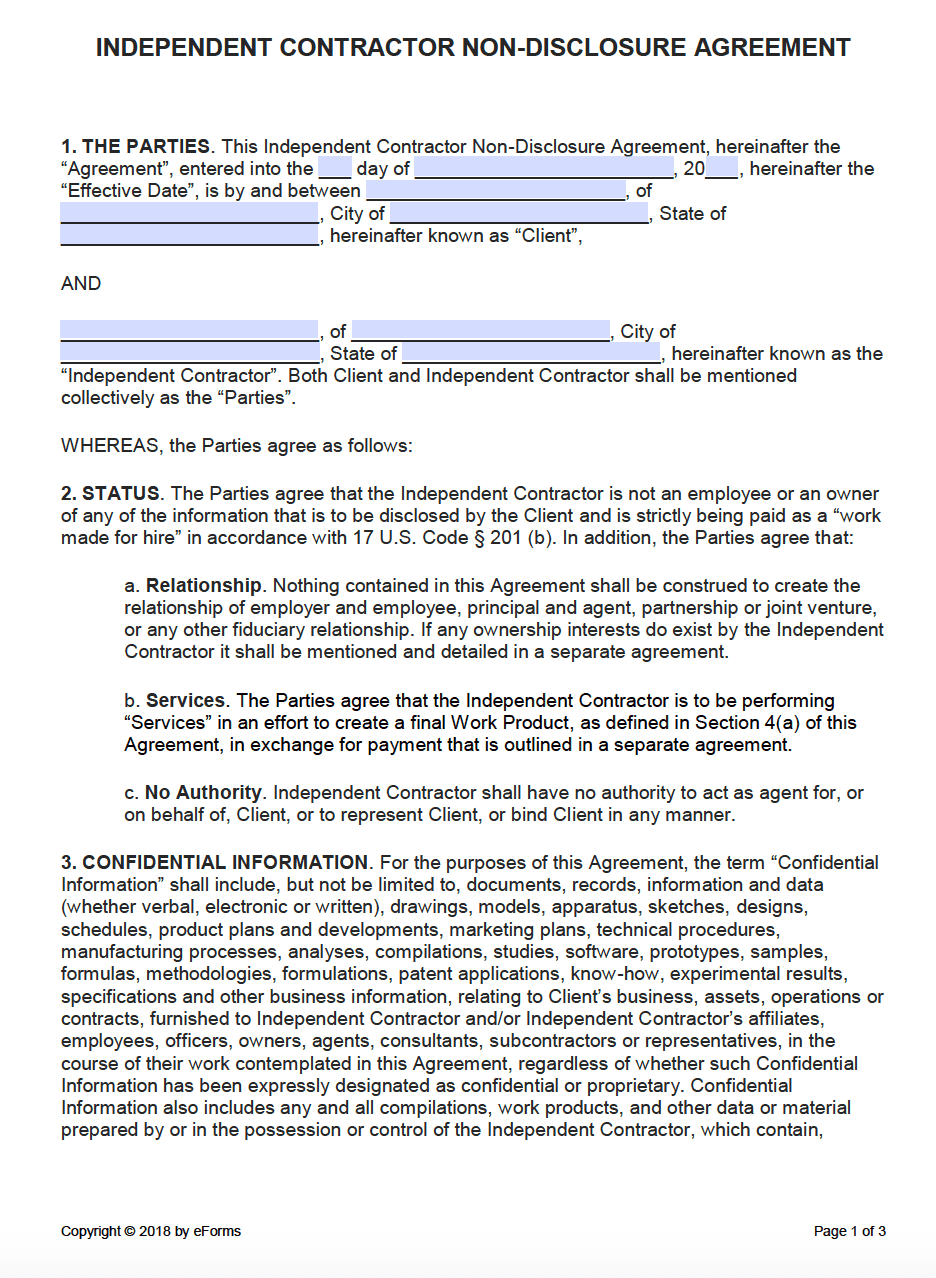

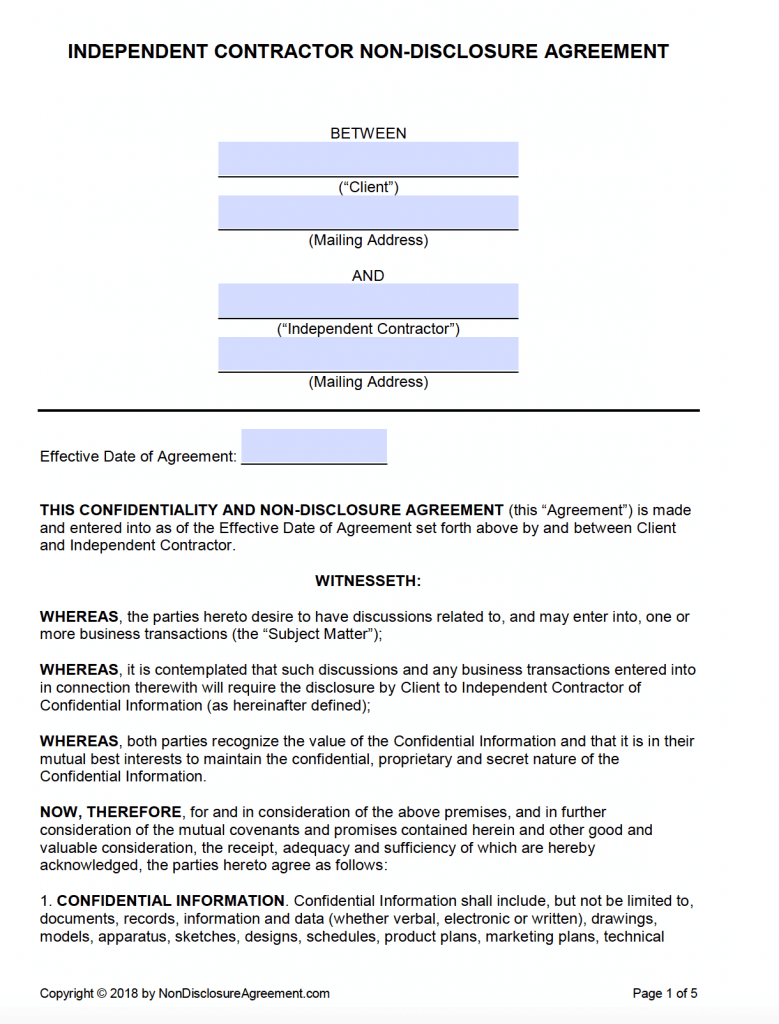

1099 Form Independent Contractor Agreement Free 1099 Form Independent Contractor Printable 1099 Form Independent Contractor Printable Independent Contractor 1099 Form 1099 Miscellaneous Form 1099 Miscellaneous Form 17 1099 Miscellaneous Form 16 1099 Miscellaneous Form 18The independent contractor nondisclosure agreement is intended for use with workers (sometimes known as "1099 contractors" because of their tax status) who perform tasks for you or your business Unlike employees, independent contractors are not bound to maintain secrecy under most state laws Integrating your 1099 rep with the rest of your staff can help minimize rampup time, streamline the transition phase, and equip your independent contractors to stay focused on their two primary selling objectives closing deals and boosting revenues Have you outsourced your sales positions to independent contractors?

Independent Contractor Contract Template The Contract Shop

50 Free Independent Contractor Agreement Forms Templates

> Irs Form 1099 Independent Contractor Irs Form 1099 Independent Contractor by Libby Tyler 21 Posts Related to Irs Form 1099 Independent Contractor Independent Contractor Form 1099 Pdf Simple Independent Contractor Agreement Form(b) Contractor will not violate the terms of any agreement with any third party; You will need a Contractor Agreement whenever you hire an Independent Contractor or whenever you will be contracted as one You will need to tailor the agreement based on the specific terms of each engagement Are there deadlines or times for when the form is needed?

Independent Contractor Agreement Example Word Document Short Form Texas

3

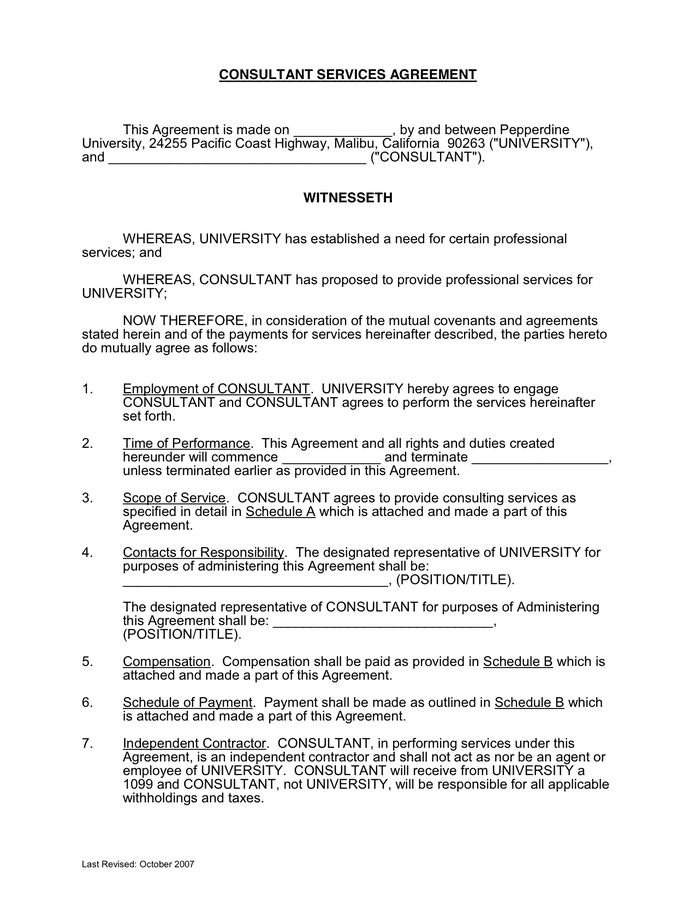

An independent contractor agreement is between a client and a company that makes a promise to produce services in exchange for paymentThe client will have no responsibility for employees, subcontractors, or personnel in connection with the services provided Their only obligation will be to pay the independent contractor with no liability if anyone should get injuredA 1099 worker is a member of staff that is selfemployed and works being a contractor that is independent It means you are not employed by someone, but you work independently on a projecttoproject basis if you are a 1099 employeeContractor represents and warrants to Company that (a) Contractor has full power and authority to enter into this Agreement including all rights necessary to make the foregoing assignments to Company;

Free Contractor Invoice Template Independent Contractor Invoice Bonsai

Free Independent Contractor Agreement Templates Word Pdf

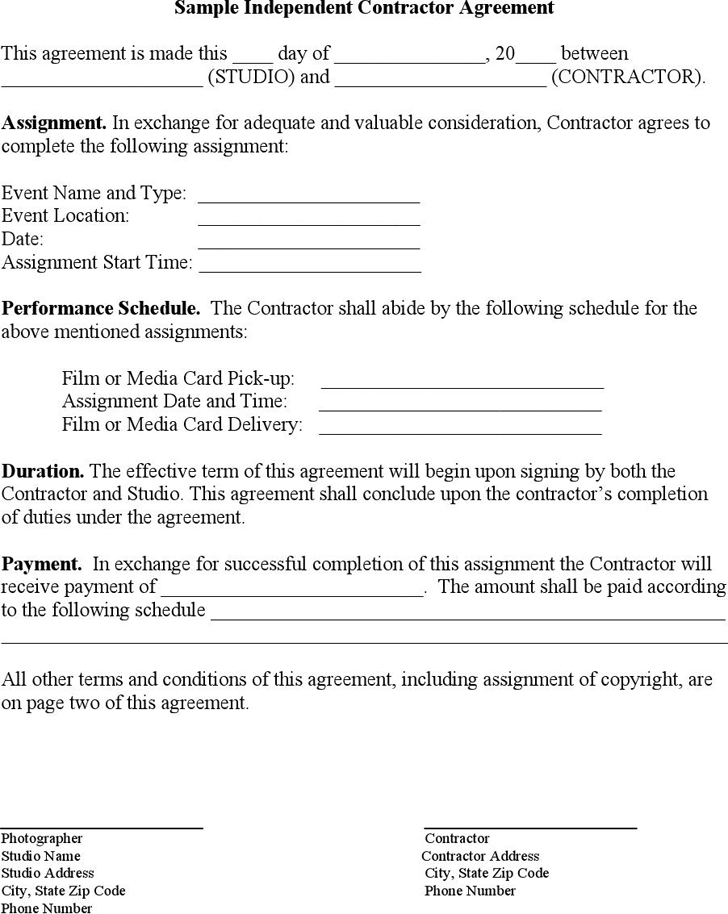

Formalize your business relationships for event decoration projects Use this Event Decorator Contract PDF template here for free!Get The Complete Presentation https//landingpageswebsiteleadpagesnet/agilitypresentationtophrissuesof14/Call (619) For More InformationNo, there are no deadlines here

Free Independent Contractor Agreement Templates Word Pdf

Independent Contractor Agreement For Programming Services Template By Business In A Box

Client will not require Contractor to rent or purchase any equipment, product, or service as a condition of entering into this Agreement 5 Independent Contractor Status Contractor is an independent contractor, and neither Contractor nor Contractor's employees or contract personnel are, or shall be deemed, Client's employees 30 Simple Independent Contractor Agreements (100% Free) 6 Mins Read You can simplify your hiring process of an independent contractor with the use of a standardized contractor agreement Before seeking service of an individual or an agency, it is important to clearly define the scope of work and put down all the relevant terms andThe independent contractor nondisclosure agreement is intended for use with workers (sometimes known as "1099 contractors" because of their tax status) who perform tasks for you or your business Unlike employees, independent contractors are not bound to maintain secrecy under most state laws

Independent Contractors

Independent Contractor Agreement

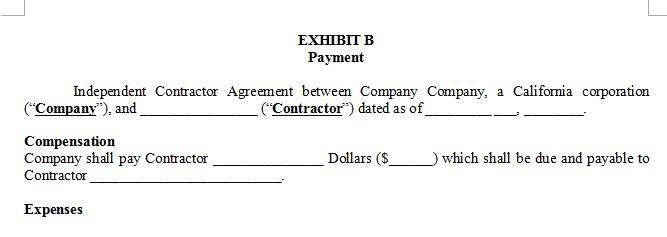

And withholdings, and Company shall file an IRS Form 1099 reflecting all contractual payments paid by Company to Contractor under this Agreement Contractor and Company further agree that 1 Contractor has the right to perform services for others during the term of this AgreementContractor represents and warrants to Company that (a) Contractor has full power An independent contractor is considered to be selfemployed, as opposed to an employee They must pay selfemployment tax— for Social Security and Medicare—as well as income taxes, but they must pay this on their own You're not responsible for withholding anything from payments you make to this personIndependent Contractor Relationship The Parties agree that the Contractor is providing the Services under this Agreement and acting as an Independent Contractor and not as an employee This Agreement does not create a partnership, joint venture, or any other fiduciary relationship between the Client and the Contractor Confidentiality

Contractor Agreement Form Pros

Free 9 Independent Contractor Agreement Forms In Pdf Ms Word

Independent contractor agreement templates a bad idea A basic internet search will give you thousands of free independent contractor agreement templates, yet you shouldn't always resort to using them for several reasons First of all, not every template will work for your specific needs and those of the contractorAn independent contractor agreement is a legally binding document signed by a 1099 employee and the company that hires them It outlines the scope of work and the terms under which that work will be completed, which goes a long way to making sure both parties are on the same page about the project from the startIn providing the Services under this Agreement it is expressly agreed that the Contractor is acting as an independent contractor and not as an employee The Contractor and the Client acknowledge that this Agreement does not create a partnership or joint venture between them, and is exclusively a contract for serviceContracts Agreement Between Pdf An independent contractor

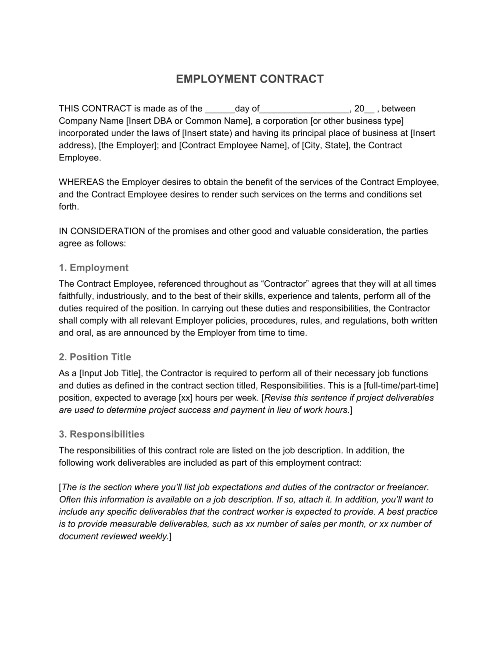

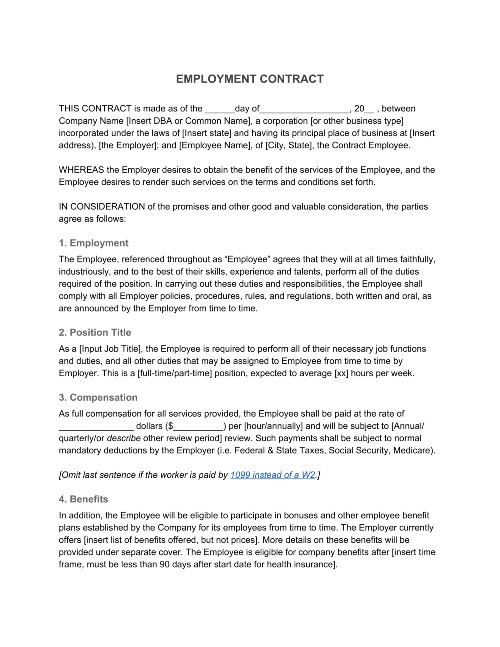

Employment Contract Definition What To Include

Independent Contractor 1099 Invoice Templates Pdf Word Excel

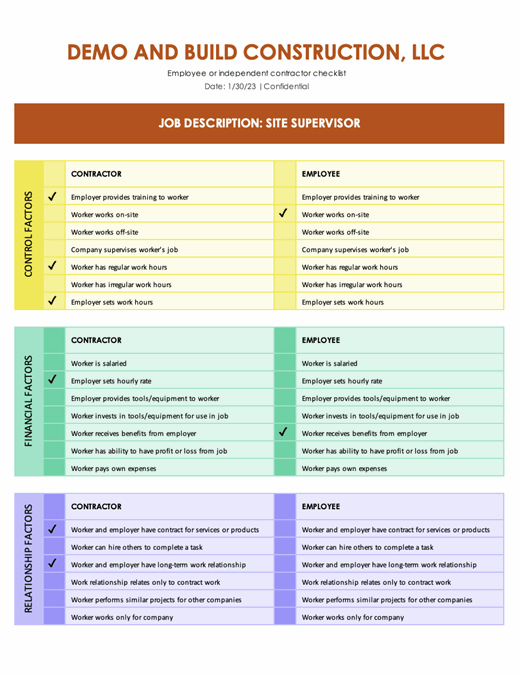

There is no minimum wage for independent contractors A 1099 contractor gives up their rights to the protections and minimums guaranteed to them by federal and state law to work as they wish Therefore, they do not have a minimum wage The wages earned by a 1099 contractor depend on the terms of their agreement with an employerThe Tricky Business of Using Independent Contractors (1099s) There are a number of factors that determine whether a person is classified as an employee (someone you provide a W2 tax form) or an independent contractor (someone you provide a 1099 form) and it is important for a business to carefully and accurately weigh these factors in order to1099 CONTRACTOR AGREEMENT AGREEMENT made as of _____, between Eastmark Consulting, Inc, a Massachusetts Corporation with its principal office at 44 School Street, Boston, MA ("Eastmark"), and _____("Contractor"), Federal Identification (or Social Security) _____

Free Florida Independent Contractor Agreement Pdf Word

Free Independent Contractor Agreement Free To Print Save Download

Irs 1099 Employee Independent Contractor Agreement September 24, If this service contract is not deemed to be honoured until the independent contractor has provided all the services the parties may decide to approve an employment contract or proceed directly to a binding written agreement of the independent contractor Paying an Independent Contractor It's quite easy to pay an independent contractor The payment type in process should be outlined in the independent contractor agreement Hourly Some contractors choose to be paid on an hourly basis This can include those who do computer programming By the job Contractors may also be paid by the jobDownload the independent contractor invoice template to formally request payment for most any type of independent contracting work This includes freelance home repair, graphic design, writing, and much more Be sure to accurately describe the work you performed and the charges being applied IRS 1099MISC Form – Filed by an independent contractor at the end of the year

1099 Form Independent Contractor Free

Freelance Contract Create A Freelance Contract Form Legaltemplates

Independent Contractor Agreement Template Free Pdf Sample Sample Independent Contractor Agreement In Word And Pdf Formats Search Q 1099 Contractor Simple Independent Contractor Agreement Tbm Isch Free Printable Independent Contractor Agreement Template Free Missouri Independent Contractor Agreement Word PdfContractor Forms Gusto will provide electronic copies of 1099NEC to your domestic contractors, and will file your 1099NEC forms to federal and state agencies (if applicable) at the end of the year We do not currently support 1099NEC filings to locals, where applicable ;And (c) the Services and any work product thereof are the original work of Contractor,

Independent Contractor Agreement Template Contract The Legal Paige

Freelance Contract Create A Freelance Contract Form Legaltemplates

The contract signed between a contractor and their client is known as an Independent Contractor Agreement This legal document is designed to outline the core elements of the transaction between the hiring client and the contractor An Independent Contractor Agreement can also be known as a Freelance Contract Consulting AgreementIndependent Contractor Agreement Example Simple Template Addictionary Form Independent Contractor Agreement Example Agreement independent contractor agreement short form the california association of realtors independent contractor agreement form 1099 independent contractor agreement form independent contractor agreement example independent contractor agreementIndependent Contractor Agreement Template An independent contractor agreement is a legal agreement between an independent contractor and their client Also called a 1099 agreement, or a business contract, this document details the services the contractor agrees to perform and the terms of the jobAn independent contractor agreement is a contract that documents the terms

10 Must Haves In An Independent Contractor Agreement

Printable Blank Contract Template

Independent Contractor Agreement Form California Elegant Independent Contractor Tax Forms Sample 1099 Form Beautiful Luxury Models Form Ideas

1099 Form Independent Contractor Agreement Unique 1099 Form Independent Contractor Agreement Example Forms For Models Form Ideas

Blank Contractor Agreement Fill Online Printable Fillable Blank Pdffiller

How To Pay Contractors And Freelancers Clockify Blog

Free Independent Contractor Agreement For Download

Free Independent Contractor Agreement For Download

2

Create An Independent Contractor Agreement Download Print Pdf Word

3

Free 50 Contract Agreement Formats In Ms Word Pdf Excel

Free 12 Sample Independent Contractor Agreement Forms In Pdf Ms Word Excel

Free California Independent Contractor Agreement Word Pdf Eforms

Freelance Contract Template Free Download Wise

Sample Independent Contractor Non Compete Agreement Word Pdf

Independent Contractor Agreement Template Contract The Legal Paige

Independent Contractor Consultant Agreement In Word And Pdf Formats

What Is A 1099 Contractor With Pictures

Melody Veitch Melodyveitch Profile Pinterest

Free Sales Representative Contract Free To Print Save Download

Employment Contract Definition What To Include

Independent Contractor Agreement Template Lawdistrict

Independent Contractor Agreement Contractor Agreement Contract Contractor Contract Sample Contractor Contract Contract Template Contractors

Sample Independent Contractor Agreement Template Free Download Speedy Template

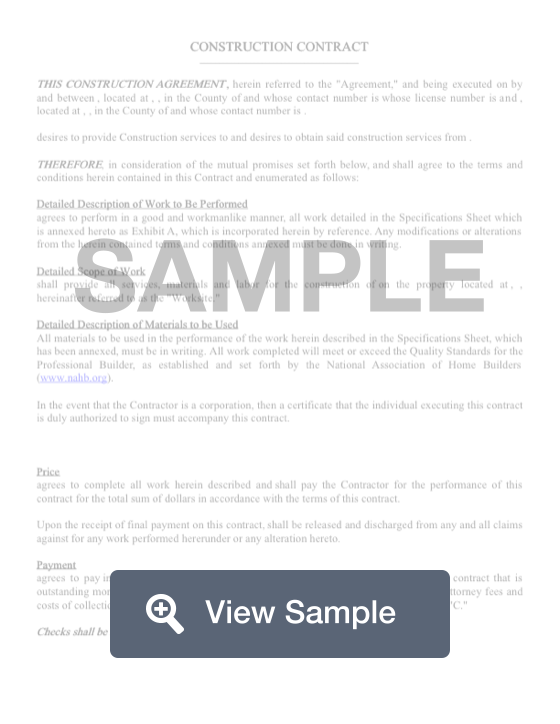

Free Construction Contract Template Pdf Word Sample Formswift

Independent Contractor Defined For Salon Owners This Ugly Beauty Business

Free Independent Contractor Agreement Template Download Wise

Independent Contractor 1099 Invoice Templates Pdf Word Excel

Free Independent Contractor Agreement Templates Word Pdf

Employee Or Independent Contractor Checklist

Use A Nda With Independent Contractor Agreements Everynda

Adding 1099 Contractors To Your Practice How To Start Grow And Scale A Private Practice Practice Of The Practice

1

Free Independent Contractor Agreement Template 1099 Pdf Word Eforms

Free Independent Contractor Agreement Template What To Avoid

/documents-when-hiring-a-contract-worker-398608_final-c7b9e3e0f1704d388f723fe60239b079.png)

3 Documents You Need When Hiring A Contract Worker

Independent Contractors Vs Employees A Guide For Pet Sitters And Dog Walkers Time To Pet

Free 9 Commission Sales Agreement Templates In Ms Word Pdf Pages Google Docs

2

Sample Independent Contractor Agreement In Word And Pdf Formats

Independent Contractor Agreement Template Lawdistrict

50 Free Independent Contractor Agreement Forms Templates

A 21 Guide To Taxes For Independent Contractors The Blueprint

Independent Contractor Agreement Free Contractor Templates 360 Legal Forms

50 Free Independent Contractor Agreement Forms Templates

Free Texas Independent Contractor Agreement Pdf Word

Self Contract Template Fill Online Printable Fillable Blank Pdffiller

Free Independent Contractor Agreement Template 1099 Pdf Word Eforms

Free 9 Independent Contractor Agreement Forms In Pdf Ms Word

Self Employed Vs Independent Contractor What S The Difference

Free Independent Contractor Agreement Templates Word Pdf

Free Independent Contractor Agreement Templates By State With Guide

8 Independent Contract Templates Free Word Pdf Google Docs Apple Pages Format Download Free Premium Templates

Free 9 Independent Contractor Agreement Forms In Pdf Ms Word

49 Sample Independent Contractor Agreements In Pdf Ms Word Excel

How To Write An Independent Contractor Agreement Mbo Partners

18 Independent Contractor Ideas Independent Contractor Contractors Small Business Tips

Free Independent Contractor Agreement Pdf Word

49 Sample Independent Contractor Agreements In Pdf Ms Word Excel

Independent Contractor Agreement Example Word Document Short Form Texas

Independent Contractor Agreement In Word And Pdf Formats

:max_bytes(150000):strip_icc()/contracting-papers-92244195-576860795f9b58346a0384c7.jpg)

Hiring And Paying An Independent Contractor

Free Subcontractor Agreement Templates Pdf Word Eforms

Free Independent Contractor Non Disclosure Agreement Nda Template Pdf Word

What Kind Of Work Can I Do As An Independent Contractor Quora

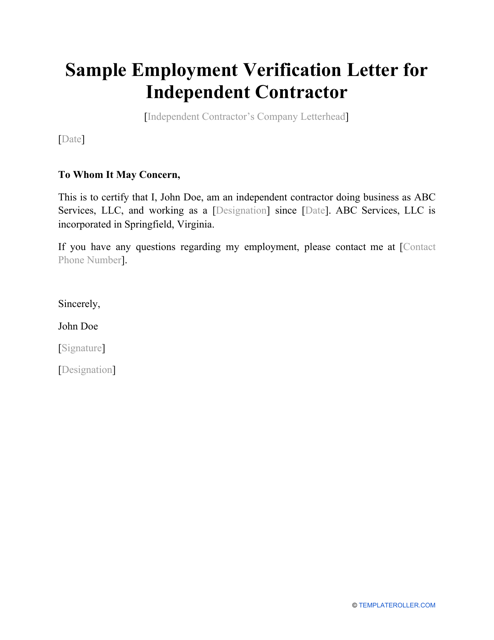

Sample Employment Verification Letter For Independent Contractor Download Printable Pdf Templateroller

50 Free Independent Contractor Agreement Forms Templates

Free Independent Contractor Non Disclosure Agreement Nda Pdf Word Docx

Free 12 Sample Independent Contractor Agreement Forms In Pdf Ms Word Excel

Independent Contractor Agreement Florida Fill Online Printable Fillable Blank Pdffiller

50 Free Independent Contractor Agreement Forms Templates

1099 Form Independent Contractor Free

2

Free Independent Contractor Agreement Templates Word Pdf

Free Independent Contractor Agreement Template Download Wise

50 Free Independent Contractor Agreement Forms Templates

Independent Contractor Agreement Pdf Template Kdanmobile

Free Subcontractor Agreement Free To Print Save Download

Independent Contractor Or Employee

0 件のコメント:

コメントを投稿