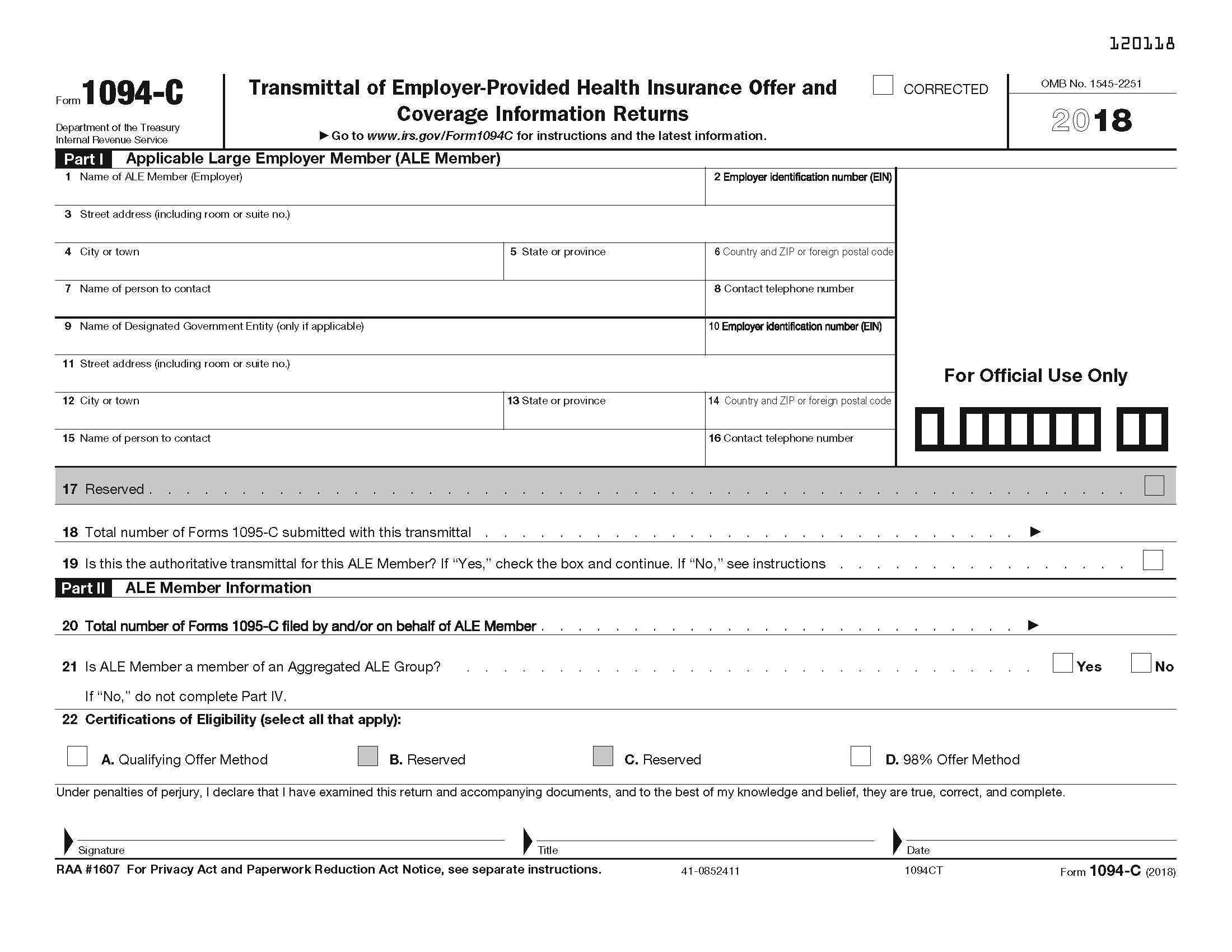

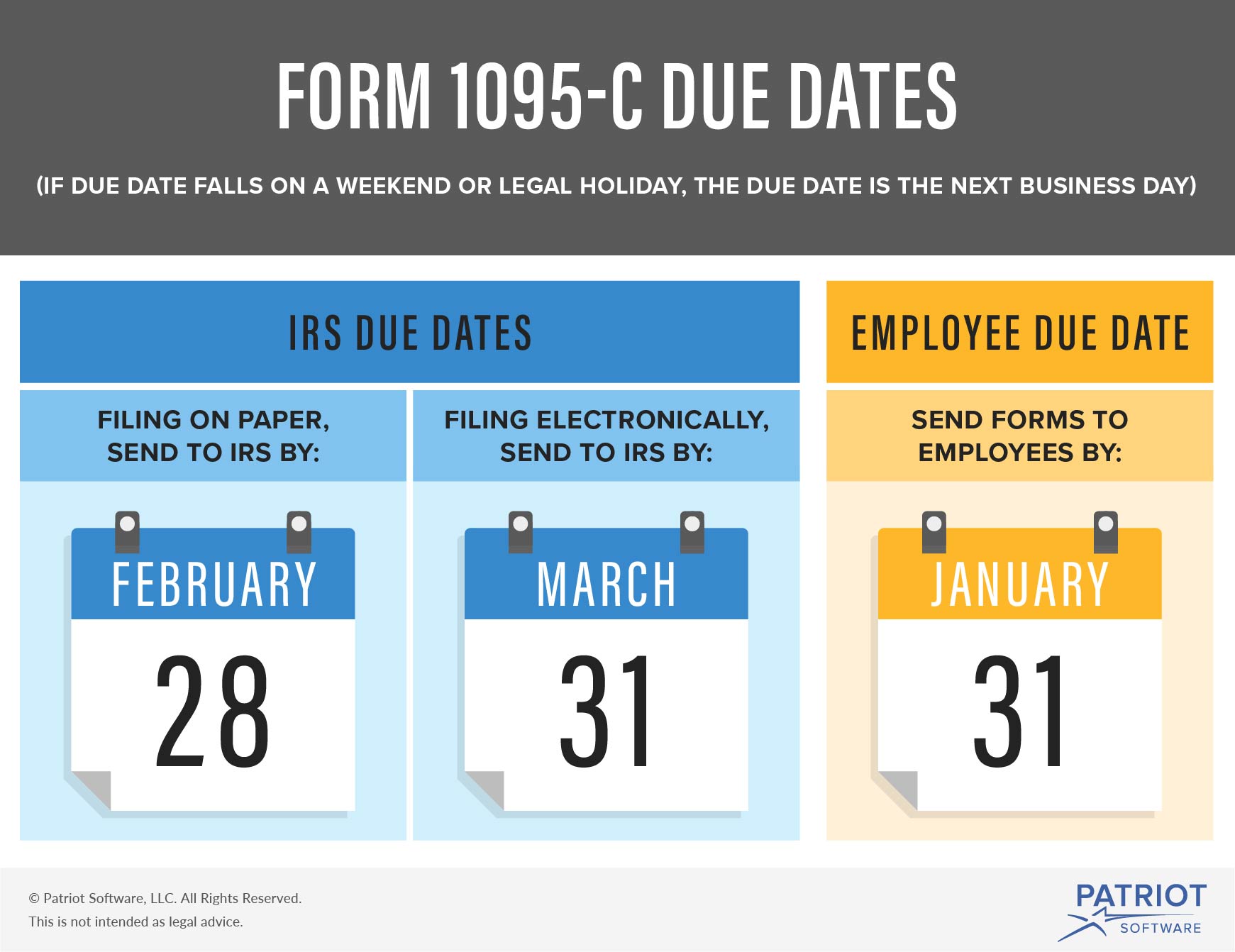

Forms 1095B, 1094C and 1095C need to be corrected if they include incorrect information The form 1094B Transmittal does not allow for corrections Form 1094B is merely a transmittal document In addition, the form 1094C that is not the authoritative transmittal does18 Form 1095C (employee statement) Due 18 Form 1094C (transmittal form with copies of Forms 1095C) Due (or , if filing electronically) If the due date falls on a weekend or legal holiday, the employer may file by the next business dayNormally, forms 1094C and 1095C must be provided to the IRS by February 28th (March 31st, if filed electronically) of the year following the year to which the statement relates Because of the extension, for calendar year 15, the 1094C and 1095C forms are required to be provided to the IRS by , or if filing

Www Scu Edu Media Offices Human Resources Documents Benefits 1094 C 1095 C Forms Guidance Pdf

1094-c 2019 deadline

1094-c 2019 deadline-Form 1094C gets auto generated based on the 1095C forms input inside the system This saves users time and simplifies the filing process As an employer you can think of the 1095C as the W2 form of ACA healthcare reporting and 1094C as the W3 transmittal of ACA reporting And the due dates are also similar Each FullTime employee must be provided an IRS Form 1095C by IRS Form 1094C, along with all FullTime employees' Form 1095Cs, must be transmitted to the IRS by March 31 every year (April 1 in 19), if an employer files these Forms electronically Employers who issue less than 250 1095C information returns may file paper copies of the

Otr Cfo Dc Gov Sites Default Files Dc Sites Otr Publication Attachments Dc health care info returns Pdf

Form 1094C is the transmittal form that accompanies Form 1095C when filing with the IRS each year Together, Forms 1094C and 1095C are used to provide information to the IRS regarding health insurance coverage offered to your fulltime employees and that status of individual employee's enrollment2 users$395 3 users$445 5 users$559 10 users$799 ez1095 19 Efile Schema Upgrade (Software only, no license key included) If you purchased ez1095 with 19 schema and need to file 19 ACA forms during the 21 tax season, you need to upgrade the efile schema $/installation If an employer is filing electronically, the deadline is However, is a Sunday Therefore, employers filing electronically have until the following Monday, to file the Forms 1094C and 1095C with the IRS Extensions An employer who is unable to meet the deadlines discussed above can file an extension

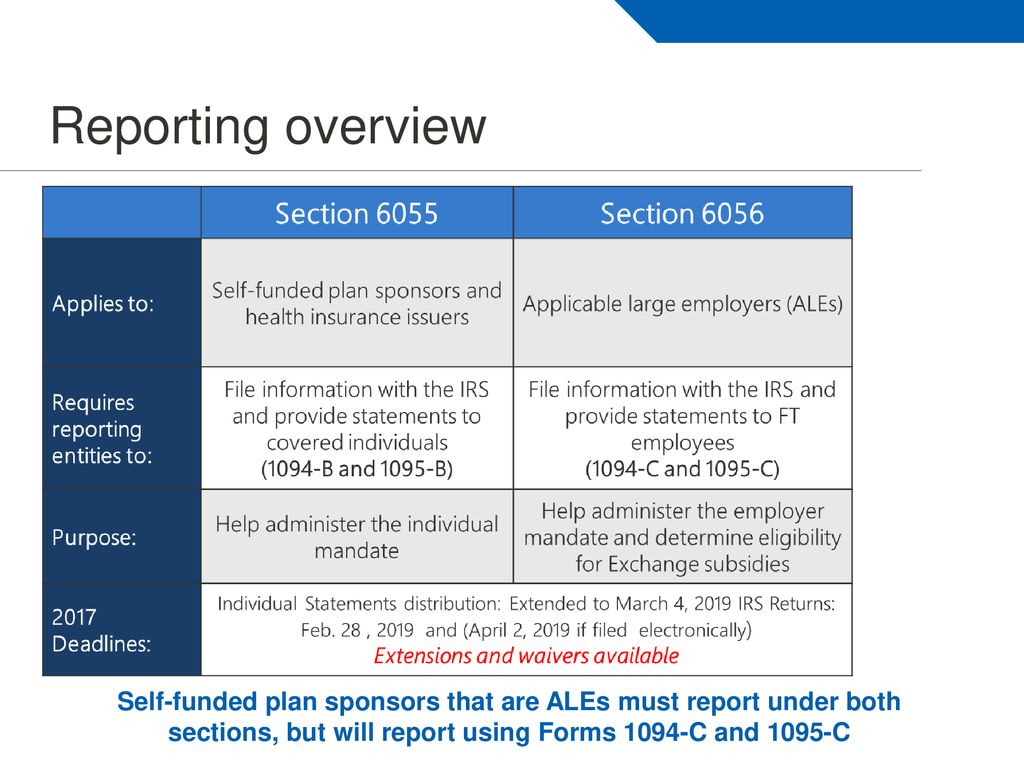

The IRS issued final versions for four ACA forms, including Forms 1094B, 1095B, 1094C, and 1095C The forms can be accessed using the following links Form 1094B Form 1095B Form 1094C Form 1095C The IRS also released full instructions for Forms 1094C and 1095C for employers and HR teams, as well as instructions for Forms 1094 The IRS has released final Forms 1094/1095B (B Forms) and Forms 1094/1095C (C Forms), and related instructions, for the 19 tax year No material changes have been made to the forms, either from prior years or from the drafts released in Joanna KimBrunetti The IRS has released draft versions of Forms 1094C and 1095C, as well as the reporting instructions for the 19 tax year, to be filed and furnished in

Form 1094C (19) DO NOT FILE DRAFT AS OF 1316 Form 1094C (19) Page 3 Part IV Other ALE Members of Aggregated ALE Group Enter the names and EINs of Other ALE Members of the Aggregated ALE Group (who were members at any time during the calendar year) Date Read Time 6 minutes Share Click to share on LinkedIn (Opens in new window) All applicable large employers (ALEs) must file Forms 1094C and 1095C with the IRS and furnish a copy of the 1095C to all fulltime employees The insurance carrier for a fully insured plan must complete Forms 1094B and 1095BBack to 1094C Form Guide ;

2

Index Of Software Images

1094C is the transmittal form that accompanies Form 1095C when filing with the IRS each year Together, Forms 1094C and 1095C are used to provide information to the IRS regarding health insurance coverage offered to your fulltime employees Fill Online, Printable, Fillable, Blank F1094c 19 Form 1094C Form Use Fill to complete blank online IRS pdf forms for free Once completed you can sign your fillable form or send for signing All forms are printable and downloadable The F1094c 19 Form 1094C form is 3 pages long and contains The electronic and paper filing deadlines have already passed for 19 ACA information Employers must provide this information to the IRS via Forms 1094C and 1095C ALEs must also provide a copy of Form 1095C to their fulltime employees, including to any person employed fulltime for one or more months of the reporting year

Http Proware Cpa Com Pdf Filing Requirements Pdf

Form 1095 A 1095 B 1095 C And Instructions

ALEs must file 18 Forms 1094C and 1095C with the IRS by if filing in paper format or by if filing electronically Electronic filing is required for 250 or more Forms 1095C Employees must be furnished with Forms 1095C byPrior Year Products Enter a term in the Find Box Select a category (column heading) in the drop down Click Find Click on the product number in each row to view/download Click on column heading to sort the list You may be able to enter information on forms before saving or printing19 Instructions for Forms 1094C and 1095C Department of the Treasury Internal Revenue Service Section references are to the Internal Revenue Code unless otherwise noted Future Developments For the latest information about developments related to Form 1094C, Transmittal of EmployerProvided Health Insurance

Aca Deadlines Penalties Extension For 21 Checkmark Blog

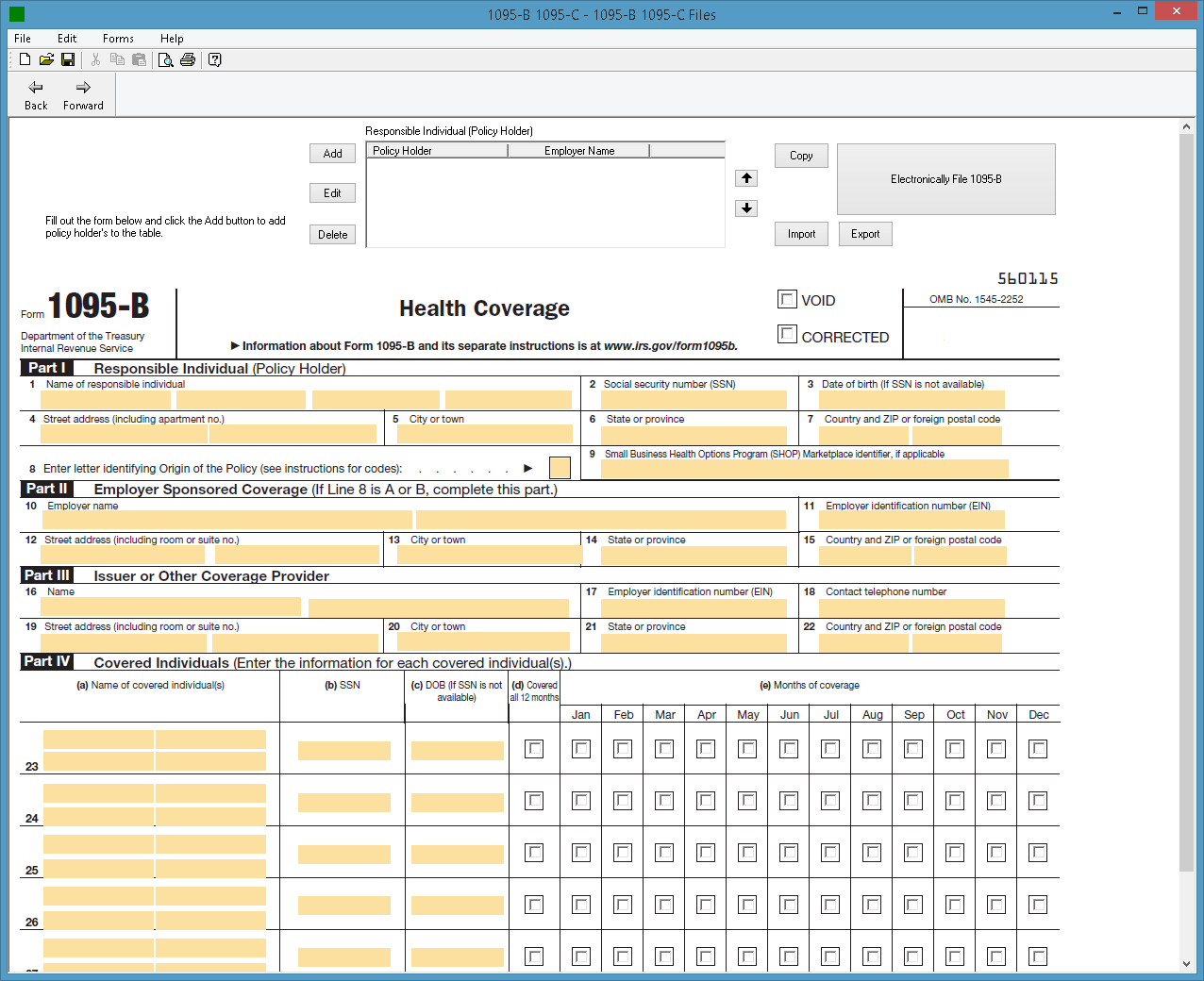

Ez1095 Software How To Print Form 1095 C And 1094 C

1218 Form 1094C () Page 2 Part III ALE Member Information—Monthly (a) Minimum Essential Coverage Offer Indicator Yes No (b) Section 4980H FullTime The law known as the Tax Cuts and Jobs Act, PL , reduced the individual mandate penalties to zero effective in 19, but for 19, Forms 1094C and 1095C still are required, and penalties still apply to failure to timely file and furnish forms correctly IRS ISSUES ACA 18 FORMS 1094C AND 1095C, INSTRUCTIONS, AND 226J FOR 16 Robert Sheen ACA Reporting, Affordable Care Act 1 minute read The IRS has released the final 1094/1095C schedules and reporting instructions for the 18 tax year, to be filed and furnished in 19 You can find the 18 instructions at this link

Www1 Nyc Gov Assets Olr Downloads Pdf Health 1095 C Form Pdf

2

The IRS imposes penalties for late filing of Forms 1094C and 1095C or for late furnishing of Forms 1095C under Internal Revenue Code (IRC) Sections 6721 and 6722 These penalties can be huge depending on the number of late Forms 1095C, at a rate of $270 per form for failure to file and an additional $270 per form for failure to furnish for the 19 tax yearThe IRS estimates that the Form 1094C alone can take up to four hours to complete The Form 1095C, which is sent to both employees and the IRS, clocks in at only 12 minutes per form For a company with 100 employees, that means you'll spend 25 hours completing them Let's make ACA reporting easierForm 1094C, Transmittal of EmployerProvided Health Insurance Offer and Coverage Information Return Filing is optional for CY 14, but required for Coverage Years starting in 15 All Applicable Large Employer (ALE) Members are required to file Forms 1094C and 1095C for Coverage Years starting in 16

Www Scu Edu Media Offices Human Resources Documents Benefits 1094 C 1095 C Forms Guidance Pdf

Irs Extends 1095 C Reporting Deadline And Good Faith Transition Relief

Tax Year 19 Forms 1094B, 1095B, 1094C, and 1095C Affordable Care Act Information Returns (AIR) Release Memo, XML Schemas and Business Rules Version 10On 1094C, option B was labeled as "Reserved" and appeared as Line 14 Code 1L on 1095C This transitional relief previously applied to people who were reporting 14 noncalendar year plans in 15 Transitional Relief is still provided under Section 4980H for noncalendar year plans that started in 15 and extended into 16Part III ALE Member Information Monthly Line 23 to Line 25 ALE Member Information Reminder Part III (Lines 2335) should only be completed on the Authoritative Transmittal for the employer In Column (a), if you offered Minimum Essential Covertage (MEC) to at least 95% of your fulltime employees and their dependents, enter "X" in

Thought Obamacare Was Gone Not Quite Accounting Today

Aca Code 1a Alert Irs Clarifies 1095 C Guidance For A Qualifying Offer Integrity Data

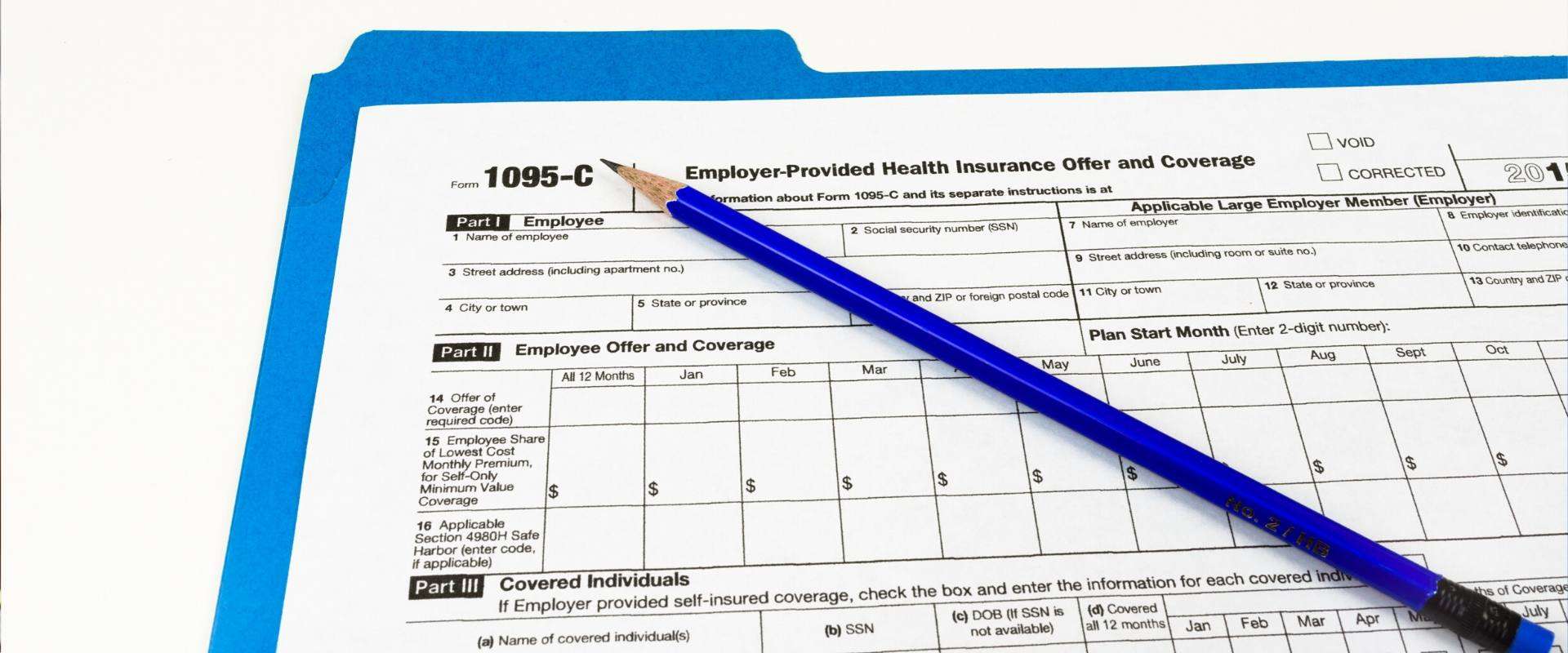

1095C C Form Instructions The IRS has released final Forms 1094C and 1095C (C Forms) and final instructions for the C Forms for the 17 tax year (Final Forms 1094/1095B, but not the instructions, have also been released We'll cover those items in a separate article after the final instructions become available)Employers are responsible for furnishing their employees with a Form 1095C by Thursday, Employers are still responsible for filing copies of Form 1095C with the IRS by Thursday, , if filing by paper or Monday, , if filing electronically (same as Form 1094C) The draft 19 versions of Form 1094C and 1095C are also available for download at the following links 19 Draft Form 1094C 19 Draft Form 1095C While these forms are not the final versions to be filed and furnished for the 19 tax year, they do serve as an accurate depiction of what employers should expect when preparing for 19 ACA

March 31 Is The Deadline For E Filing Aca Returns With The Irs The Aca Times

Form 1095 A 1095 B 1095 C And Instructions

The information below is for Tax Year 19 Learn more about the 1095C for Tax Year In the coming weeks, you may receive a tax document called the 1095C that will contain detailed information about your healthcare coverage if you were eligible in 19 While you will not need to include your 1095C with your 19 tax return, or send it to the IRS, you may use information Sequoia Blog ACA Reporting Deadlines in 19 18 IRS Instructions for Forms 1094C and 1095C 18 IRS Instructions for Forms 1094B and 1095B IRS Guide for Electronically Filing Affordable Care Act (ACA) Information ReturnsDraft Tax Forms Enter a term in the Find Box Select a category (column heading) in the drop down Click Find Click on the product number in each row to view/download Click on column heading to sort the list You may be able to enter information on forms before saving or printing

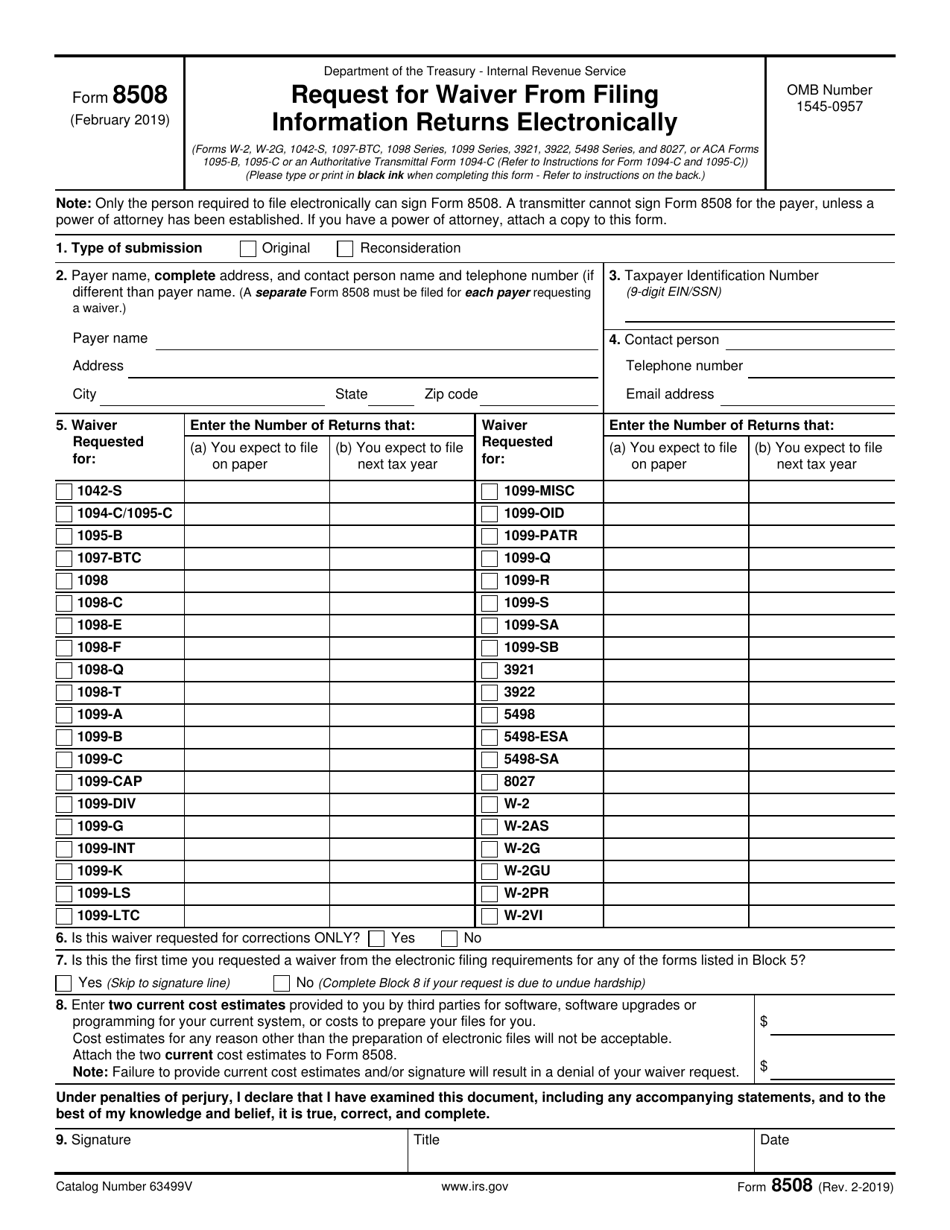

Irs Form 8508 Download Fillable Pdf Or Fill Online Request For Waiver From Filing Information Returns Electronically Templateroller

Www Irs Gov Pub Irs Utl Instructions for ty18 predefined aats scenarios Pdf

The Affordable Care Act (ACA) imposes demanding reporting responsibilities on employers each calendar year since 15 The reporting stipulation states that an information return will be prepared for each applicable employee, and these returns must be filed with the IRS using a single transmittal form (Form 1094B & 1095B or Form 1094C & 1095C)What are the deadlines for Forms 1094 C and 1095 C in 19?1094c 1921 Complete blanks electronically using PDF or Word format Make them reusable by making templates, include and complete fillable fields Approve documents using a lawful electronic signature and share them via email, fax or print them out Save forms on your laptop or mobile device Improve your productivity with powerful solution?

The Irs Is Issuing Penalties For Not Providing 1095 C Forms By Irs Deadlines Update The Aca Times

2

Source IRS The IRS announced that electronic filing of ACA information returns (Forms 1094/1095) for the 18 tax year will become available on Jan 15, 19 Filing With IRS ALEs must file the 19 Form 1094C transmittal (and copies of related Forms 1095C) with the IRS by , if they are filing on paper ALEs filing electronically must file the Form 1094C transmittal (and copies of related Forms 1095C) with the IRS byIf this is the only Form 1094C being filed for the ALE Member, this Form 1094C must report aggregate employerlevel data for the ALE Member and

19 Aca Reporting Update Hub International

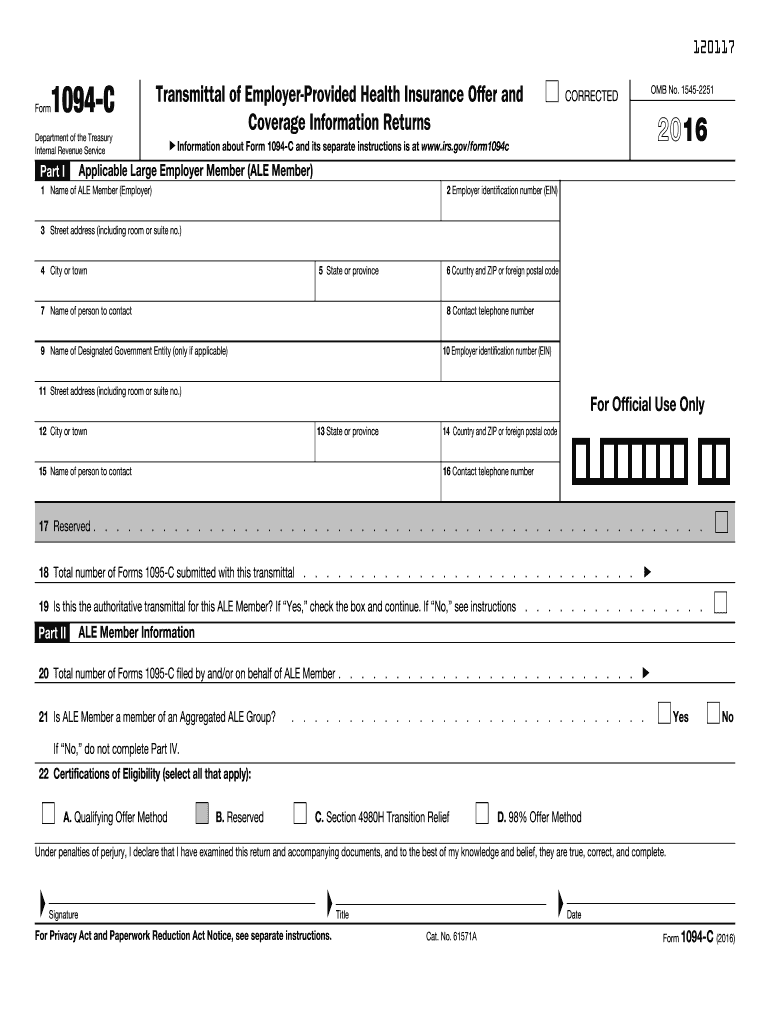

16 Form Irs 1094 C Fill Online Printable Fillable Blank Pdffiller

Prior Year Products Enter a term in the Find Box Select a category (column heading) in the drop down Click Find Click on the product number in each row to view/download Click on column heading to sort the list You may be able to enter information on forms before saving or printing IRS Forms 1094C and 1095C are filed by employers that are required to offer health insurance coverage to their employees under the Affordable Care Act, also known as Obamacare However, the IRS extended goodfaith transition relief from penalties to ALEs for incorrect or incomplete information on 1094C/1095C for the 15 through tax filing year, similar to the extension they provided during the 19 tax filing season

How To Choose Form 1095 C Codes For Lines 14 16 Aps Payroll

1095 C Reporting Determining A Company S Ale Status Integrity Data

Small employers must file Forms 1095C and 1094C if they are members of a controlled or affiliated service group Last December, the IRS also posted Instructions for Forms 1094C and 1095C1094C Department of the Treasury Internal Revenue Service Transmittal of EmployerProvided Health Insurance Offer and Coverage Information Returns Go to wwwirsgov/Form1094C for instructions and the latest information OMB No 19 Part I Applicable Large Employer Member (ALE Member) 1 Name of ALE Member (Employer) 2 The deadline to file the Forms 1094C and 1095C with the IRS is if the employer is filing on paper If an employer is filing electronically, the deadline is Please contact Accord Systems if you have any questions or need assistance filing the Forms 1094C and 1095C

Aca Employer Reporting Requirements 1094c 1095c Efile4biz

2

The 1094C form is not considered a correction by the IRS if it is being submitted as the cover page for one or more corrected 1095C forms The accompanying 1094C form is simply a new form and the data on it should reflect what is being submitted with it (eg, if 1 form needs correcting, Line 18 on the 1094 form will state "1" even

Irs Final Aca Compliance Forms Now Available Bernieportal

Some Draft Forms For Aca Reporting Released Resecō

2

Your 1095 C Obligations Explained

2

Aca Compliance Bulletin Draft Section 6056 Reporting Forms Released Vcg Consultants

2

Released Phase Ii Patches For The 19 Employer Shared Responsibility Reporting Under The Affordable Care Act Oracle E Business Suite Support Blog

2

1094 C Transmittal Of Employer Provided Health Insurance Forms Fulfillment

Www Medica Com Media Documents Group Employer Employer Update 19 Employer Update November 19 Pdf La En Hash Aed3eda76e631bff93fffe71ef3b95f0

Dps Ascentis Aca Brochure Pdf 791x1024 1 Jpg

Irs Releases Draft 19 Aca Reporting Forms And Instructions Alera Group

2

Your 1095 C Obligations Explained

6055 6056 Reporting Tool Overview Ppt Download

Www Hayscompanies Com Wp Content Uploads 18 10 Here Come The 1095s Pdf

2

New Jersey State Individual Mandate Tango Health Tango Health

2

Office Depot

2

Otr Cfo Dc Gov Sites Default Files Dc Sites Otr Publication Attachments Dc health care info returns Pdf

Www Scu Edu Media Offices Human Resources Documents Benefits 1094 C 1095 C Forms Guidance Pdf

Http Cbplans Com Wp Content Uploads 19 12 Aca 19 Final Forms 1094 C And 1095 C Issued Pdf

Updated Guidance Released On Employer Reporting For The California Individual Mandate Sequoia

Otr Cfo Dc Gov Sites Default Files Dc Sites Otr Publication Attachments Dc health care info returns Pdf

2

Complete Guide To State Individual Mandates Tango Health Tango Health

Totalsource Adp Com Demos Userguides Benefits Enrollment Core Aca Tax Reporting Data Collection Guidee Pdf

2

2

Bondbenefitsconsulting Com Wp Content Uploads 19 02 Bond Compliance Calendar Pdf

2

2

Http Www Ci Dearborn Heights Mi Us 04 23 19 backup Ocr Pdf

Benefits Buzz February 19

Www Irs Gov Pub Irs Utl Instructions for ty18 criteria Based aats scenarios Pdf

Get To Know Aca Forms 1094 C And 1095 C The Aca Times

2

2

2

2

2

2

Form 1095 C Basics Best Practices And Hr Compliance Bernieportal

2

2

Flock Standalone Aca Reporting By Flock Adp Marketplace

2

Irs Issues Draft Form 1095 C For Aca Reporting In 21

Aca Software Hrdirect

Final 19 Aca Forms 1095 C And 1094 C Released Benetech

19 Rolls Royce Phantom For Sale In Norwell Ma P Mclaren Boston

Deadlines Loom As Employers Prep For Aca Reporting In

2

Www Cbiz Com Linkclick Aspx Fileticket Tiiy1s9y5pg 3d Portalid 0

2

Www Irs Gov Pub Irs Prior Ib 19 Pdf

2

Legal Alert Irs Releases Draft 19 Aca Reporting Forms And Instructions Spring Consulting Group

2

2

Ecommerce Issisystems Com Isite0 Eremitimages 0 Documents Aca notice to employers re 1094 1095 reporting november 19 2 Pdf

2

Nj Employers And Out Of State Employers With Nj Residents Prepare State Updates Website On Employer Reporting For New Jersey Health Insurance Mandate Health Employment And Labor

2

How To File 1099 S Online 1095 S Online With Efilemyforms

Irs Issuing 1094 C 1095 C Penalties Essential Staffcare

2

2

2

2

Otr Cfo Dc Gov Sites Default Files Dc Sites Otr Publication Attachments Faq reporting srp update 3 31 Pdf

2

Www Irs Gov Pub Irs Prior P5223 19 Pdf

0 件のコメント:

コメントを投稿